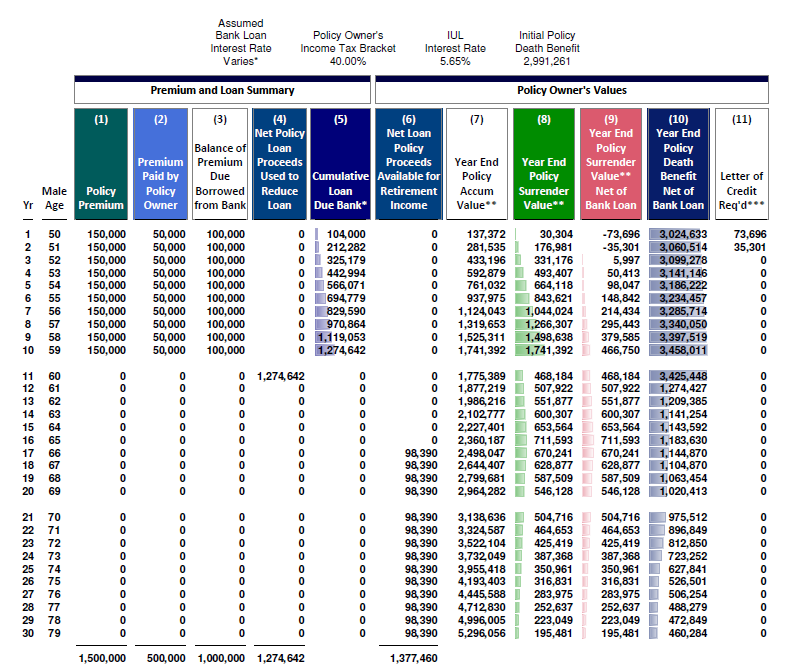

Anyone who believes their life insurance policy is actually earning the dividend rate or projected crediting rate stated on the illustration may be in for a surprise. Method of purchasing life insurance by paying the required premiums with borrowed funds from a third party lender.

2021 Ultimate Guide To Premium Financed Life Insurance - Banking Truths

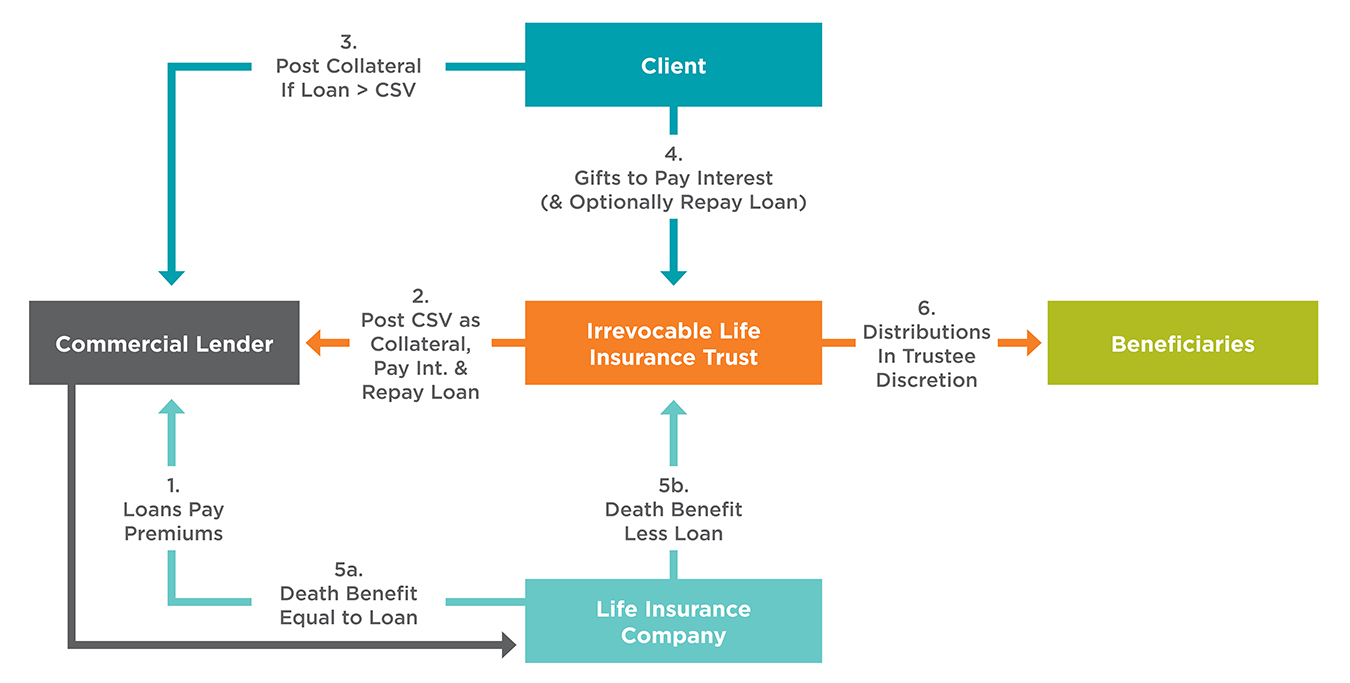

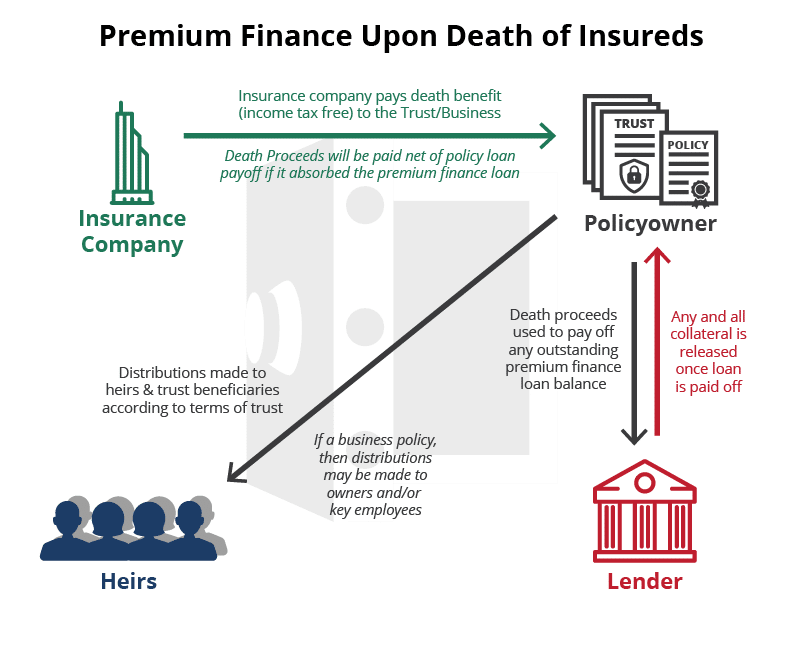

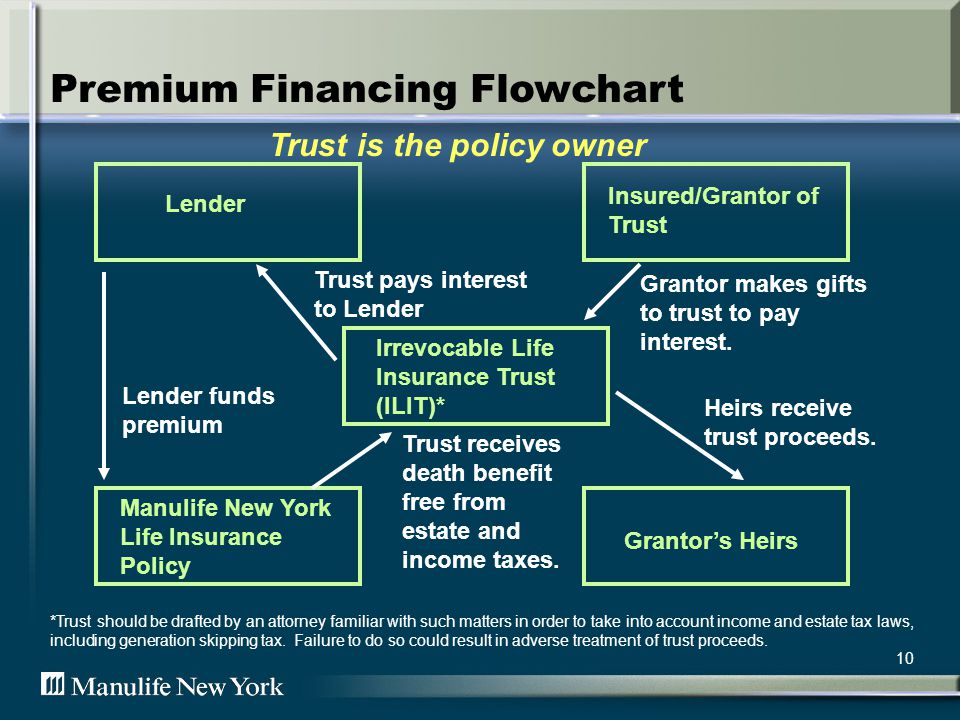

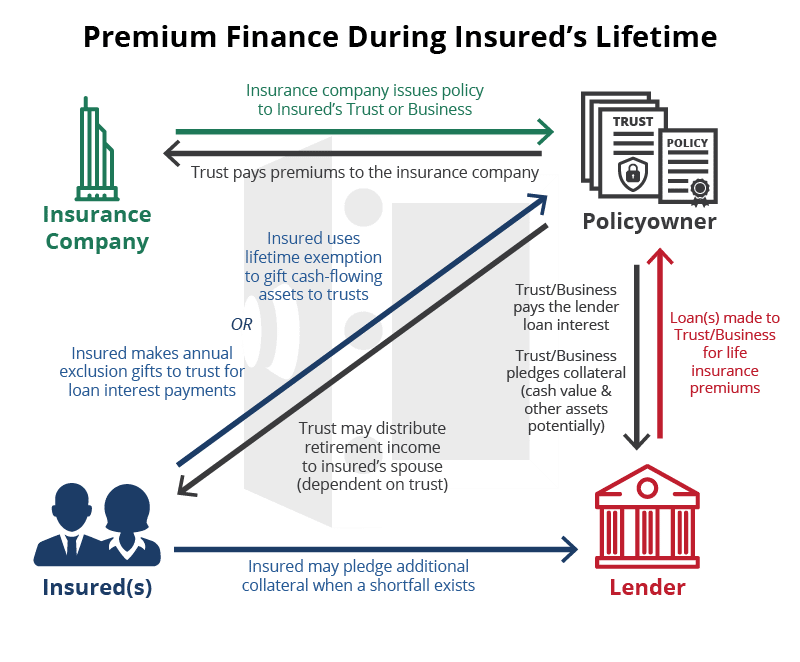

The following diagram demonstrates how the premium financing process generally works.

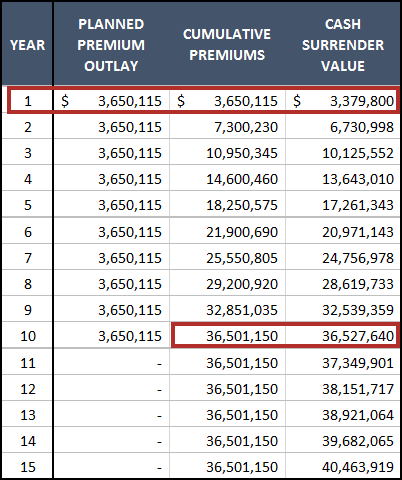

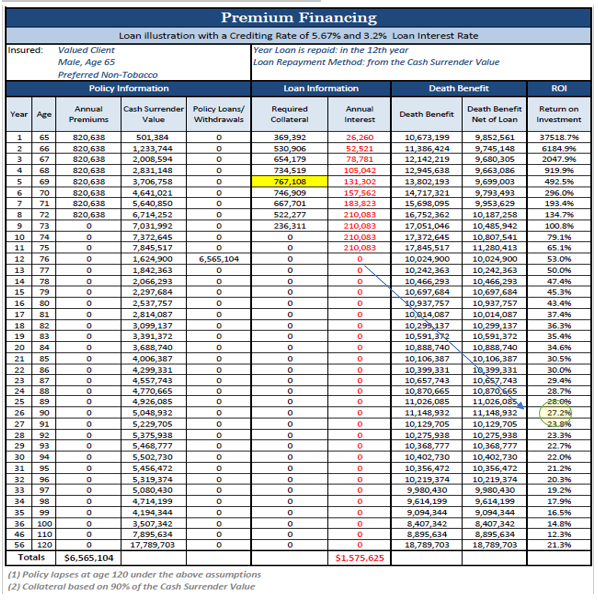

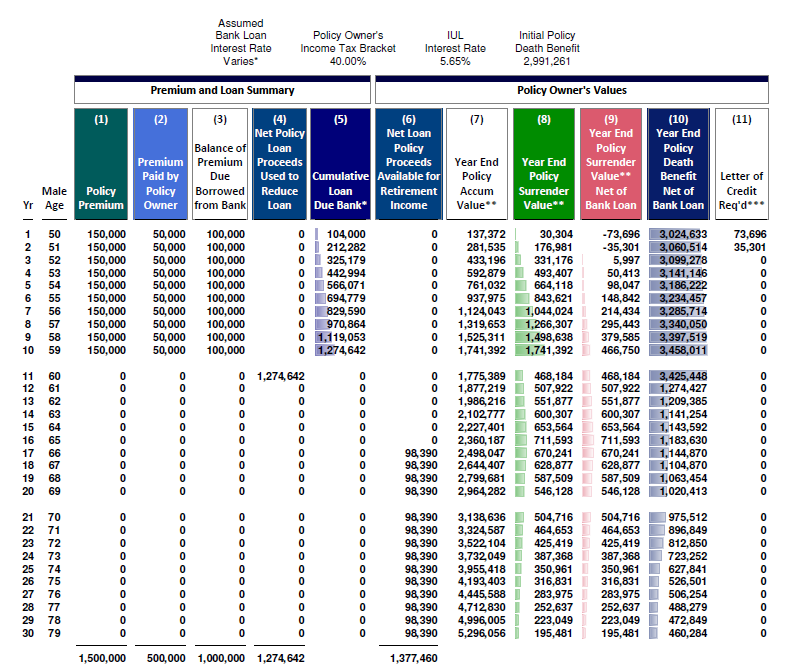

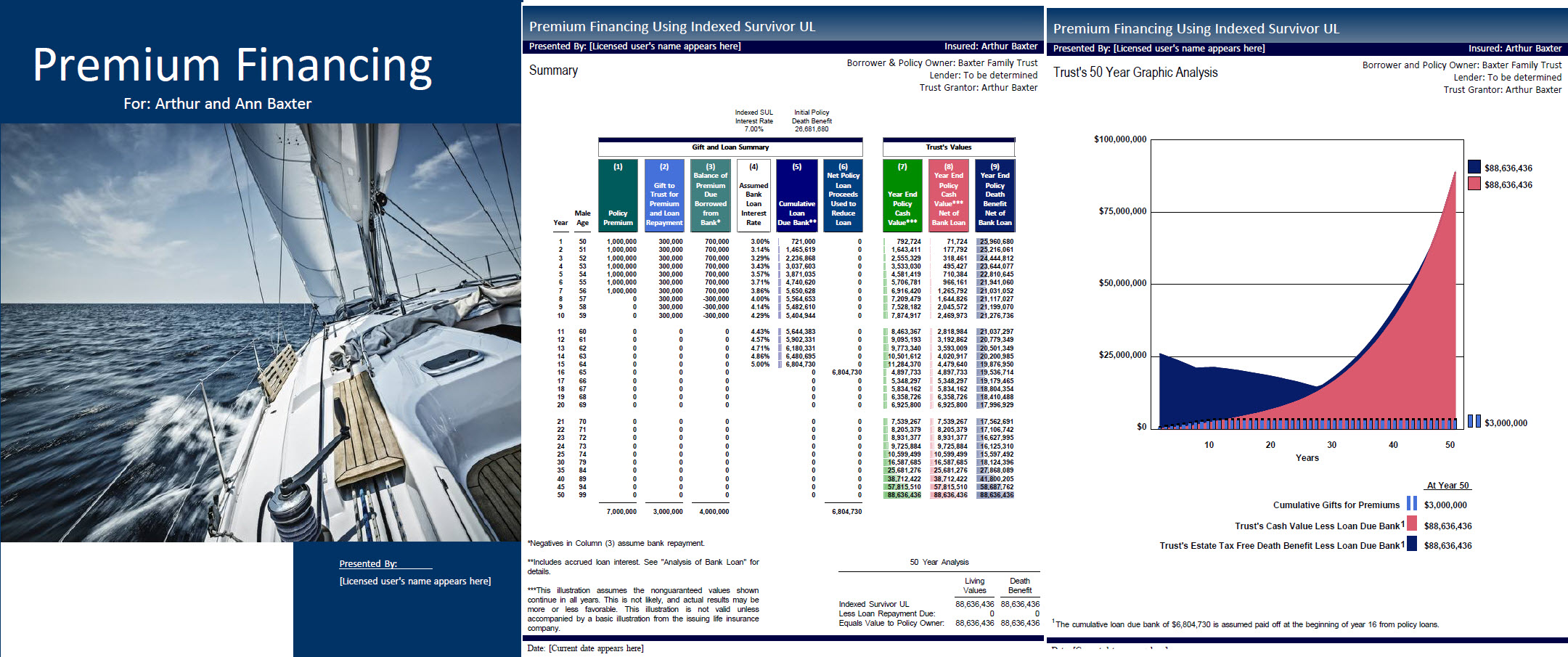

Premium financing life insurance illustrations. Typically, the life insurance illustration will project cash values and death benefits based on a fixed interest crediting rate. Finally, in the short time that this proposal was being considered, the carrier reduced their cap rates; Policy owned by an irrevocable life insurance trust.

Term life insurance that will give you peace of mind. The fact that it uses a life insurance policy is purely incidental. However, you do have the flexibility to reduce your premium without changing the death benefit or anything else in the policy.

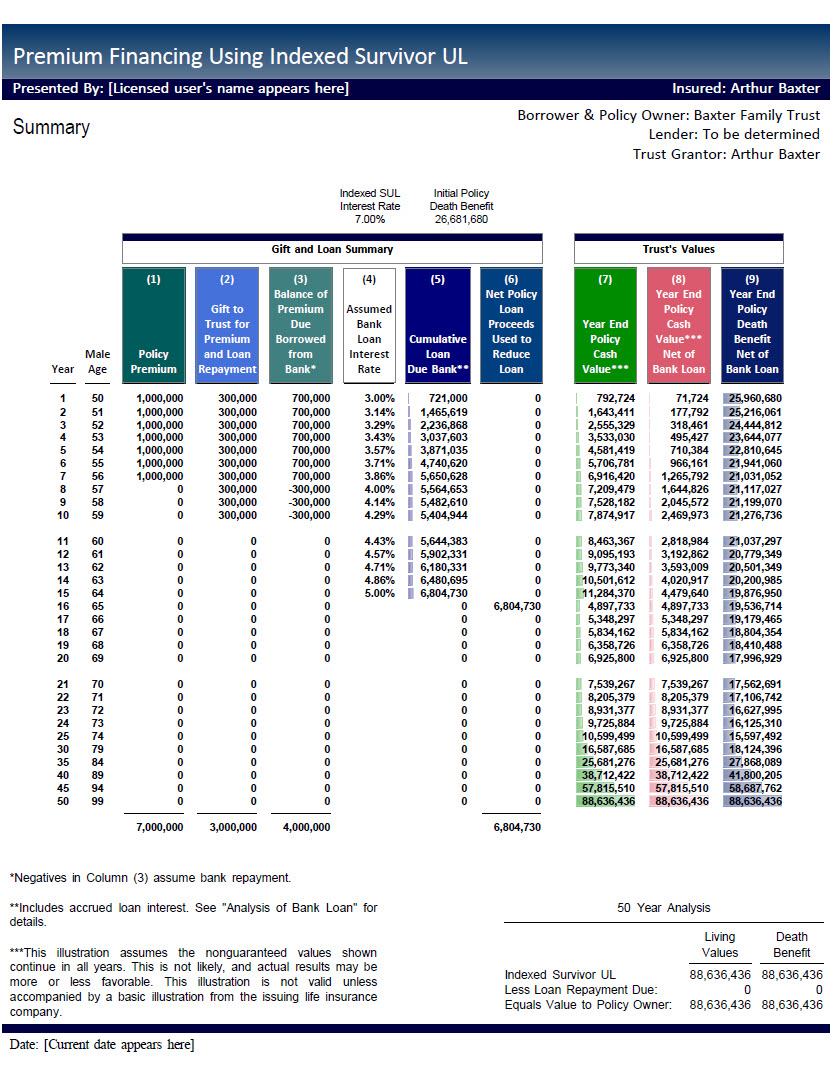

In some years, performance may be worse. (ipfm) has been structured to address the requirements and perspectives of three constituents: Life insurance supplemental illustration using premium financing to purchase life insurance through your legacy trust may be an attractive alternative for getting the benefits of life insurance without potentially jeopardizing your assets' ability to earn interest.

And that’s the real problem. When a universal life insurance policy is designed to be funded right up to the guideline level premium, you cannot put any more money into the policy without violating the definition of life insurance. The bank loan pays the life insurance premiums for a defined period of time, and then the policy becomes paid up (no more premiums).

That’s an extra $2.4m of life cover. 5 pacific life insurance company’s pacific discovery xelerator iul 2 (policy form #p15iul and s18pdx2 or icc15 p15iul and icc18 s18pdx2, based on state of policy issue) is indexed universal life insurance (iul). That’s 5x the life cover by financing your premium.

Ad are you worried about your future? Most premium finance clients and agents alike simply pick the winner of the illustration beauty contest when choosing the underlying premium financed life insurance product. Term life insurance offers peace of mind.

Term life insurance that will give you peace of mind. Family protection estate liquidity wealth transfer charitable planning. The international market premium financing can also be attractive to citizens of other countries who need life insurance protection.

We are in the life insurance industry. You invest $200,000 and finance the remaining $800,000, giving you total life cover purchasing power of $1m*. Typically, you will use your life insurance to pay for estate taxes.

Policy owned by an individual or a business. Life insurance premium financing for many investors, the primary purpose of life insurance is to provide financial protection to surviving spouses, children and significant others. Generally, the insurance policies are structured using ten pay premium payment options and the loan facility is drawn to fund large portions of the annual premiums and, as an option in certain structures, a portion.

Overall policy performance may be better or worse than projected. Source of premiums if the policy is owned by an irrevocable life insurance trust. One common use of life insurance is for estate tax liquidity.

This shows how sensitive these illustrations are and how dangerous they can be to unsuspecting clients who are being pitched premium finance arrangements using par loans to pay off bank loans. The policy owner will still have to pay for the interest on. Allows for dual leveraging and arbitrage opportunity by using the lenders capital to finance life insurance premiums and retain the use of your assets for other investment opportunities.

With borrowing, you can afford to buy $3m of life cover (5 x $600,000). Its variations include the following: Premium financed indexed ul is so.

Premium financing structures combine a permanent life insurance policy and a loan facility, both tuned to reach a desired outcome. In fact, they dropped cap rates twice since the onset of covid in march. Life insurance premium financing is a way to fund life insurance with a bank loan.

It is borrowing money from a third party to pay the policy premiums. Clients should be shown policy illustrations with and without riders to help show the rider’s impact on the policy’s values. Insurative premium finance massachusetts, inc.

In some years, performance may be better than illustrated. The client is eventually responsible for paying back the loan with interest. It is not a way for a policy to be sold to someone who can’t afford the premiums.

Ad are you worried about your future? No single product is right for everyone, and the same goes for premium financing. Life insurance illustrations are just that.

This is an assumed rate. Only those clients that can write a check to pay the premium are suitable to using premium financing. What is premium financing for life insurance?

It provides a death benefit for: In order for those illustrations to actually come true one has to assume that nothing will change in the future. They use current economic and insurance company circumstances projected long into the future.

Life cover with premium finance. Term life insurance offers peace of mind. Premium financing is a tool, a way for the affluent client to buy the insurance policy.

Premium Financing For Estate Planning Purposes Chamberlin Financial Inc

Premium Financing Plans Allmerits Financial

Life Insurance Premium Financing - Ppt Video Online Download

Best Practices Financing Life Insurance Premiums

The Best Premium Financing Life Insurance Top Benefits To Maximizing Your Cash Flow And Retained Capital

Premium Financing Illustration - Life Insurance Planning For High-net Worth Families And Business Owners

Structuring Life Insurance Premium Financing For Maximum Benefits

2021 Ultimate Guide To Premium Financed Life Insurance - Banking Truths

Premium Financing Life Insurance - What Can Go Wrong - Agency One

Premium-finance Whole Life Insurance

Premium Finance Life Insurance - Series Intro - Newyork City Voices

Premium Financing Insmark

Life Insurance Premium Financing - Ppt Video Online Download

![]()

Finance Insurance Icon In Two Color Design Line Style Icon From Insurance Icon Collection Ui And Ux Pixel Perfect Premium Finan Stock Illustration - Illustration Of Icons Life 127237811

2021 Ultimate Guide To Premium Financed Life Insurance - Banking Truths

The Magic Of Premium Finance Life Insurance The Insurance Doctor

A Rational Approach To Premium Financing - Agency One

Premium Financing Insmark

The Art Of Premium Financing Getting What You Pay For

Comments

Post a Comment