Below is the explanation of the values that are required to add to the calculator for calculation. Try sun life’s life insurance calculator to find out how much life insurance you may need to help financially protect the people you love most.

Whole Life Insurance Quotes Smartassetcom

Also known as whole or ordinary life insurance, the policy has a term length that lasts your entire life.

Straight life policy calculator. Included are options for tax, compounding period, and inflation. Free interest calculator to find the interest, final balance, and accumulation schedule using either a fixed starting principal and/or periodic contributions. For example, if the rate is $0.2 per $1,000 and an enrollee elects $15,000 in coverage, the monthly premium will be $3.

Mostly these tools & calculators are also available on the official website of the insurance companies. This is the amount to be paid by life insurance firms on insurance policies.insurers consider the applicant’s age, health history (self and family), driving records, employment, hobbies, etc. 100% online or with help from a licensed agent.

Please check out our article on accelerated underwriting if you prefer whole life insurance with no exam. Further, whole life insurance rate quotes can be specified as to exam and no exam required carriers. Identify where you are prepared and where you might need to make some adjustments with a customized assessment of.

Ad term life insurance beyond work benefits. How are life insurance rates calculated? It pays a lump sum after a specified number of years or upon death.

Term insurance provides coverage for a predetermined period of time. This includes your premium payments, insurer policies, type of policy, and loan balances. A life insurance premium calculator is a tool that provides an approximate amount of insurance premium according to the policy selected by you and other technicalities like age, policy term, premium frequency, the sum assured, etc.

Also, learn more about different types of loans, experiment with other loan calculators, or explore other calculators addressing finance, math, fitness, health, and many more. As a policy holder, your cash value is usually unique for several reasons. Alternatively, if you are simply looking for some ballpark whole life insurance quotes, you can enter your information into our whole life insurance calculator below.

Free loan calculator to determine repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans, and bonds. All life insurance calculators & tools. Put simply, it’s a life insurance policy that doubles as an investment or a savings account.

The primary unit for figuring out a life insurance rate is the rate per thousand (cost per $1000 of insurance), which can vary depending on which factors influence it (age, gender, etc). At the end of year 15, lee stopped paying premiums. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums.

By using a whole life insurance calculator, you can take steps to secure your family’s financial future. Estimate how much coverage you may need to replace your income and get a quote. Ad term life insurance beyond work benefits.

Unlike a term life insurance policy, though, which you may very well outlive, whole life insurance lasts for the rest of your life. This is different from term life insurance, which expires after a set number of years. A whole life insurance policy builds equity, known as cash value, and is guaranteed for the rest of your life once in place.

While determining how to calculate the premium of life insurance. 100% online or with help from a licensed agent. Term life insurance beyond your work benefits.

You can also talk to a sun life advisor to learn more about your insurance options and how life insurance can benefit you and your family. A licensed agent can assist you in finding the right whole life insurance policy for you. The rest is put into an investment fund.

Here are few things that you should know when you want to calculate cash value of life insurance. Purchasing whole life insurance is an easy way to financially protect your loved ones without worrying about policy expiration dates. If after 20 years she no longer pays premiums, what nonforfeiture options are available to her?

Each month you put a set amount of money into an account, and a specific portion of that money is used to buy life insurance. To calculate your life insurance coverage needs: Also explore hundreds of other calculators addressing investment, finance math, fitness, health, and many more.

Annual premium cash value amount of paid up insurance extended term years days ; Term life insurance beyond your work benefits.

Double Declining Balance Depreciation Calculator

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

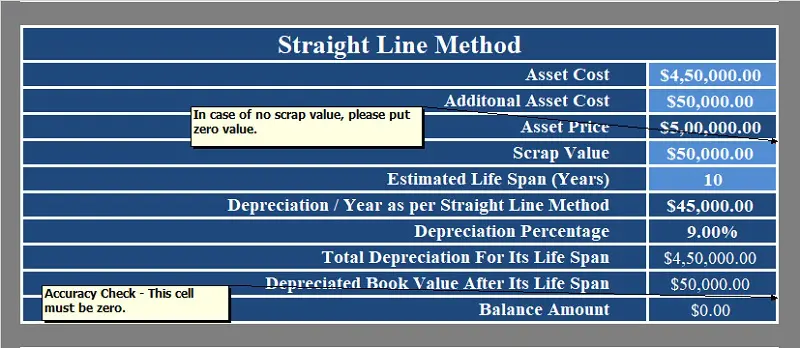

Download Depreciation Calculator Excel Template - Exceldatapro

How Much Are Life Insurance Quotes In 2021 Life Insurance Quotes Life Insurance Facts Life Insurance Marketing

Period Certain Annuity What It Is Benefits And Drawbacks

Whole Life Insurance Quotes Smartassetcom

What Are The Difference Between Annual Straight Line Amortization Vs Effective Interest Amortization The Motley Fool

Download Depreciation Calculator Excel Template - Exceldatapro

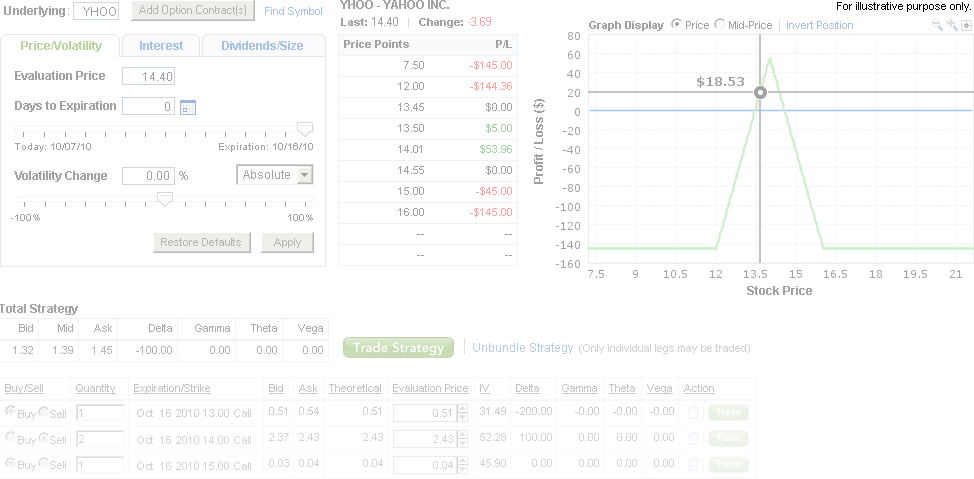

Pl Calculator Fidelity Investments

Prime Cost Straight Line And Diminishing Value Methods Australian Taxation Office

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Macrs Depreciation Calculator - Straight Line Double Declining

Macrs Depreciation Calculator - Straight Line Double Declining

Life Insurance Calculator Policygenius

Bond Amortization Calculator Double Entry Bookkeeping Amortization Schedule Nurse Brain Sheet Mortgage Tips

Joint And Survivor Annuity The Benefits And Disadvantages

How Does Whole Life Insurance Work Costs Types Faqs

Life Insurance Calculator Policygenius

Straight Line Depreciation Template - Download Free Excel Template

Comments

Post a Comment