Taxpayer qualifies as a bank within the meaning of section 581 of the internal revenue code. It should be noted that boli’s current tax benefits.

Bank-owned Life Insurance Boli

For example, we advise clients on the application of internal revenue code sections 101(a)(2) (regarding transfers for value),.

Bank owned life insurance tax treatment. The fdic is adopting a substantially identical interim rule with request for. It can help banks deliver on benefit promises made to employees and enable them to provide more competitive benefit programs while containing costs. Ad don’t delay on getting term life insurance.

As death benefits are not taxable income to the beneficiary of a life insurance policy, an idf investment made through a life The bank purchases and owns an insurance policy on an executive’s life and is the beneficiary. While any insurance owned by a bank can be referred to as boli, the term is most often applied to insurance marketing programs in which life insurance is offered to a bank specifically as an opportunity for the bank to take advantage of tax deferred cash value growth.

In general, proceeds from life insurance policies are tax free under the general exception rules in sec. Tax treatment of key man life insurance. Taxpayer is a national banking association and is wholly owned by parent, a holding company and bank holding company.

Unlike term life insurance, a whole life policy has an investment component or “cash value” in. The buildup of cash surrender value within the policy is included in book earnings but excluded from the calculation of federal taxable income. Bank owned life insurance (boli) is a tax efficient method that offsets employee benefit costs.

Typically, the cost of key man life insurance is not tax deductible. Your company can only deduct key man insurance premiums if they’re considered to be part of the employee’s taxable income, in which case the employee is typically the beneficiary. But if they are not grandfathered, they may be surrendered for their cash surrender values.

The new provision could have unintended consequences for bank mergers and. This swift expansion is due to the very favorable tax treatment applied to these policies. Ad don’t delay on getting term life insurance.

If the tax treatment of bank owned life insurance (boli) changes existing plans may be grandfathered. Some banks may choose to share a portion of these proceeds with plan participants. This general rule changed when sec.

Worry less about the future with term life insurance. As an asset on the bank’s 101 (j) (1) was added with the enactment of the pension protection act of 2006, p.l.

The bank purchases life insurance on a select group of management including officers or other key personnel. Bank owned life insurance (boli) is an excellent vehicle for financing the cost of employee benefits. This, of course, is done within the context of a legitimate business reason for a bank owning life insurance.

Unlike traditional bank investments, the Worry less about the future with term life insurance. The primary benefit of boli is its treatment for corporate income tax purposes.

The cash surrender value of those policies totals $182.2 billion.

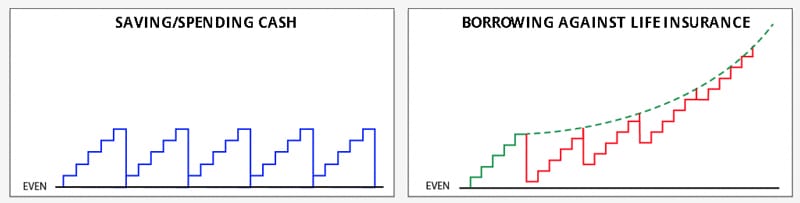

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Loans A Risky Way To Bank On Yourself

Is Life Insurance Taxable Forbes Advisor

Cash Flow Banking With Whole Life Insurance Explained

Unwinding An Irrevocable Life Insurance Trust Thats No Longer Needed

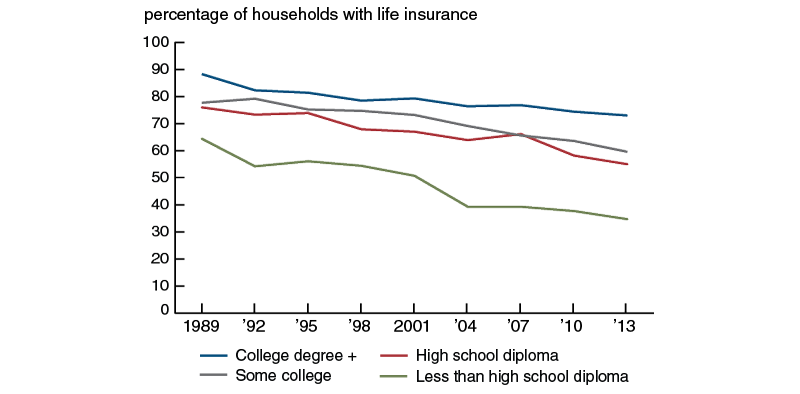

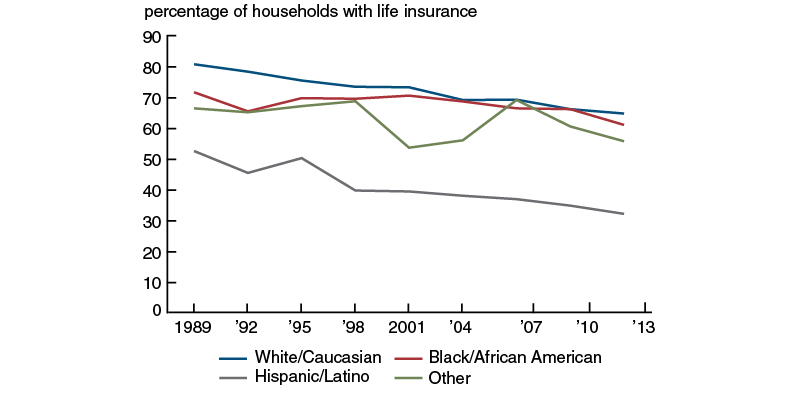

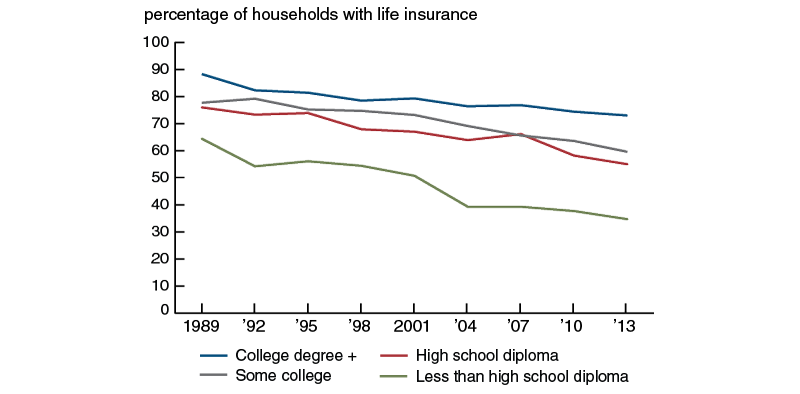

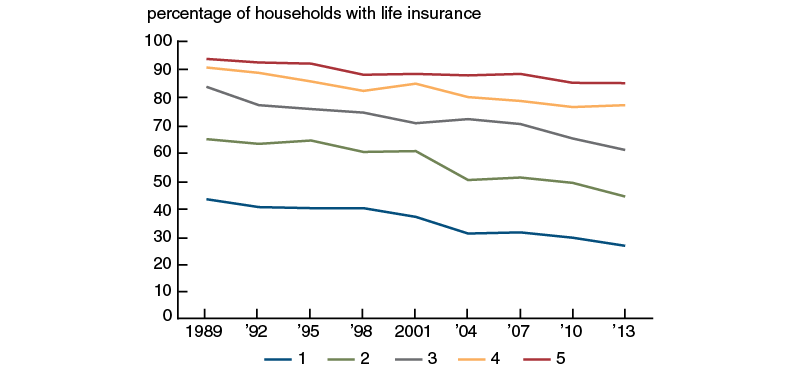

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

Tax Deductible Life Insurance Business Owners

5 Steps To Be Your Own Bank With Whole Life Insurance - Banking Truths

Insurance Journal Entry For Different Types Of Insurance

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

/GettyImages-539244461-88be1a7f24a049229ce2956e0a60d393.jpg)

Corporate Ownership Of Life Insurance Coli Definition

Here Are The Benefits Of Bank-owned Life Insurance Independent Banker

Life Insurance Loans A Risky Way To Bank On Yourself

Bank Ownership In Imf Working Papers Volume 2017 Issue 060 2017

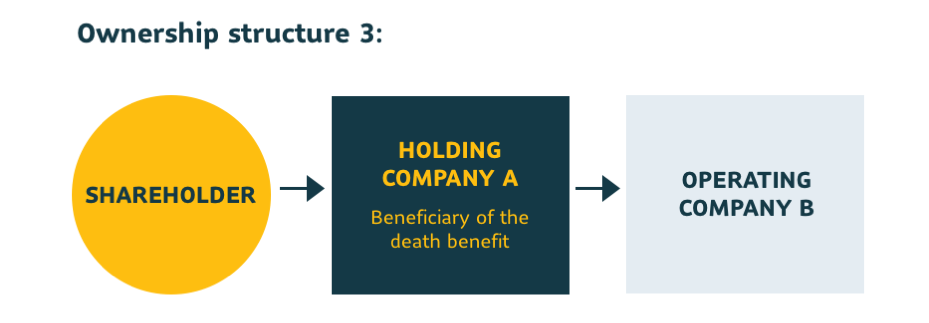

Sun Life Advisor Site - Corporate Ownership Of A Life Insurance Policy

Life Insurance Policy Loans Tax Rules And Risks

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

Life Insurance Loans A Risky Way To Bank On Yourself

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank-owned Life Insurance Boli

Comments

Post a Comment